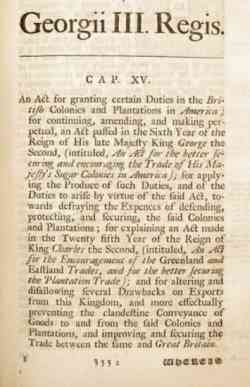

The Revenue Act of 1764, also known as the Sugar Act, was the first tax on the American colonies imposed by the British Parliament. Its purpose was to raise revenue through the colonial customs service and to give customs agents more power and latitude with respect to executing seizures and enforcing customs law. That the Act came from an external body rather than a colonial legislature alarmed a handful of colonial leaders in Boston who held that the Act violated their “British privileges”. The Revenue Act of 1764, also known as the Sugar Act, was the first tax on the American colonies imposed by the British Parliament. Its purpose was to raise revenue through the colonial customs service and to give customs agents more power and latitude with respect to executing seizures and enforcing customs law. That the Act came from an external body rather than a colonial legislature alarmed a handful of colonial leaders in Boston who held that the Act violated their “British privileges”.

Their principle complaint was against taxation without representation. Just as important, however, were the Act’s profound implications for the colonial judicial system, for the Revenue Act of 1764 allowed British officers to try colonists who violated the new duties at a new Vice-Admiralty court in Halifax, Nova Scotia, thus depriving the colonists of their right to trial by a jury of their peers. The seriousness of this was not lost on the Massuchusetts Legislature: “The extension of the powers of the courts of vice-admiralty has, so far as the jurisdiction of the said courts hath been extended, deprived the colonies of one of the most valuable of English liberties, trials by juries” (Petition from the Massachusetts Legislature to the House of Commons, 3 November 1764). The Act also established new trial procedures which essentially freed customs officers from all responsibility and from effective civil suits for damages in colonial courts.

While a handful of colonial leaders recognized the grave implications of the Revenue Act, it was not until news of the Stamp Act reached the colonies that the seeds of rebellion were planted in the hearts and minds of the broader public. |

The Revenue Act of 1764, also known as the

The Revenue Act of 1764, also known as the